For those of you who don’t know, the Wisely card is a prepaid card; references to a digital account refer to the management and servicing of your prepaid card online digitally or through a mobile app. It is not a credit card that builds credit and only works as a debit payment card.

So if you’ve recently enrolled in the Active Wisely Direct Card program, and want to know about the process of its activation, you have come to the right place.

In this article, we are going to tell you all about the Wisely card – from its different types and benefits to how you can activate it. So if you are here for it, read on!

Wisely is a brand that offers personalized payment solutions that are fast and reliable. With that, it also provides advanced electronic payments for purchases so that users can broaden their financial inclusion with a range of management tools. Used by more than 39 million workers worldwide, Wisely is a source for US workers for getting their payroll, saving money, and managing their expenditures.

Using Wisely, the users get to have a broader range of management tools and better financial inclusion. Issued by ADP on behalf of Fifth Third Bank and Member FDIC, the users can rely on it as it is supported by credible banks. Wisely offers Visa and MasterCard options, which are easy options and can be used anywhere the big brands are accepted.

Now, if you are wondering why exactly you or anyone should use the Wisely card, let’s discuss.

Also, Read: The Advantages of a Debt Management Plan for Your ACFA-Cashflow Cash Advance

The Wisely card can be used online, via phone, or in stores/malls for almost any purpose like shopping, traveling, or eating. The users will get cashback rewards as well. The card can be used to withdraw cash from ATMs where it is accepted. The users can also check their balance as and when they want to and keep a track of their savings/expenses.

Not only that, but Wisely Paycard also helps some workers by depositing paychecks into an account. And they can also spend it via a debit card connected to this account.

Wisely offers two types of reloadable accounts, with cards and apps for convenient online banking:

So these were the two different types of Wisely cards. Now, let’s discuss how it can be activated using different ways.

In order to start using your Wisely card quickly, you need to activate it.

If you have recently enrolled in the Wisely Pay card and don’t have much clue about the activation process of it, continue reading. There are basically two ways for activation of the Wisely Card, and we are going to explain both of them thoroughly along with their steps below.

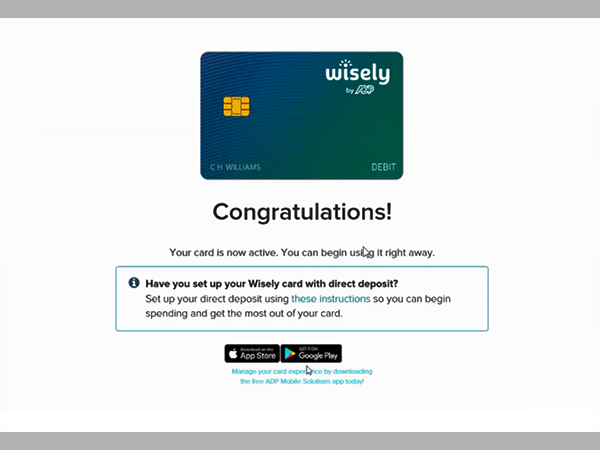

Before starting with the steps for activating the Wisely card, make sure that you keep your card’s 16-digit number and expiry date ready for the activation page. After this, follow the steps given below:

Apart from this, there is another way to activate your Wisely Card easily – through a phone. Want to know how? Read on.

You can easily activate your Wisely card over the phone. It is a quite quick and easy method to activate the Wisely card. Follow the given steps to do so:

After you get your card, you can use it wherever the MasterCard cards are accepted and also get cash from the accepted ATM(s).

Disclaimer: Beware of fake calls and scammers. Wisely Pay doesn’t make any calls to help or ask you for activating your Wisely Pay Card.

Once your card has been successfully activated, all you have to do is log in before making any payments. For doing that, follow the given steps:

And that’s it! Now, you are successfully logged in to your myWisely app, and you can take full advantage of the premium features.

Read This Also: Searscard.com Login | Sears Credit Card Login | Official Login

By now, you must have pretty much got an idea of what a Wisely card is and how you can activate it using different ways. We will now be discussing some benefits of Wisely card activation below:

So these were some positive points that you get to have by activating your Wisely pay card.

Ans: To use your card for purchases:

Do this wherever Apple Pay, Samsung Pay, Google Pay, or other online payment methods are accepted.

Ans: Yes, you get premium features using which you can add funds directly from different places like Western Union, a second job, and other different benefits without having to pay any fee.

Ans: It is pretty easy to get your Wisely card information. All you have to do is log in to myWisely.com or simply download the myWisely app (Google Play and App Store). Then head over to Account Numbers under Account Settings.